If you are a Federal Employee, then you are also a part of the “Federal Employees Retirement System”.

This is a very good pension plan, but its details may seem a little complicated.

In this blog, we are going to talk about a very simple way to calculate Basic FERS Pension.

Generally, there are Total 3 Legs of FERS pension plan…Out of which today we are going to talk about Just FERS Basic Benefit.

Formula of FERS Pension

High-3 Average Salary × Years of Service × Pension Multiplier = Your Annual Basic Pension

So now to understand this whole formula easily, let’s understand each of its parts in details.

High – 3 Average Salary

The basic highest pay salary of any 3 years in any company you work in is called High -3 average Salary.

For many people, this can also be the basic salary of the last 3 years of their job.

This section only includes salary, not overtime or bonuses.

( Your pension is based on your peak earning years, rewarding you for your career progression. )

Your Years of Creditable Service

This is the total number of years you have worked for a company that is covered by FERS.

Unused sick leaves are also included in this, which gives a boost to your final pension.

( Your dedication and your unused sick days, directly increase your retirement income )

The FERS Pension Multiplier

There are two main multipliers in the FERS Pension System.

(A) The 1% Multiplier

This is a standard factor for most employees.

If you retire before age 62 or at age 62 or before completing 20 years of service, then your pension is calculated with 1% Multiplier.

(B) The 1.1% Multiplier (Bonus)

If any employee retires after completing more than 20 years of service at age 62 (or after), then at that time, the pension is calculated with 1.1% Multiplier.

This is a special Bonus who work longer.

Example

So now let’s understand all this theory as an example,

John is a Federal Employee…

High-3 Average Salary – $90000

Years of Service – 30 Years

Retirement Age – 62 Age

John has retired after providing more than 20 years of service at age 62, then his pension will be multiplied by 1.1%.

$ 90000 × 30 Years × 1.1 % = $29700 per year

So, John will get $29700 pension Annually, Which is $2,475 per month before any deductions.

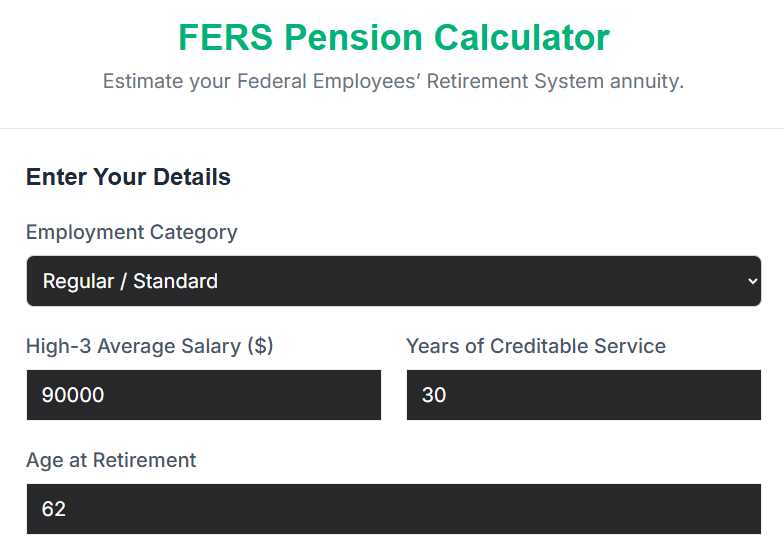

FERS Pension Calculator

If you want to make this calculation easy then you can use our “FERS Pension Calculator” tool.

This tool is absolutely Free and Easy to use, which also has a User Friendly UI.

FERS Pension Calculator