There are different rules for Pension Calculation in all countries, today we are going to talk about Pension Calculation of Employees in the United States.

Basic Pension Calculation in the “United States” requires 3 Magic Ingredients.

Understand which with the following Formula….

Years of Service × Final Average Salary × Pension Multiplier = Your Annual Pension

So now let’s break down these three Ingredients to understand them in detail.

Years of Service

This is the count of how many years you have worked as an Employer.

Basically, the more years you work in any company…the more Pension you get.

( This Number Represents your Dedication and Loyalty )

Final Average Salary (FAS)

Your Pension is not based on the Starting Earning Salary when you start a Job, it is based on the Salary you get at the Peak point of your career.

The Final Average Salary (FAS) generally refers to the average of your earnings during a defined timeframe, which is usually the last 4 to 5 years of your job.

This is done so that your Pension reflects your Highest Earning Potential, so that you can live a good Lifestyle even after Retirement.

( This is a snapshot of your highest earning years )

The Pension Multiplier

The Pension Multiplier is also known as the “Benefit Factor”, which is a small percentage set by the Employer.

Its Usually Somewhere between 1% and 2.5%.

You can think of this as a Credit that you have earned for each year of service.

When you start working for any company, you gradually start getting these Credits.

At first, these percentages may seem small to you…but later, when you multiply this with your service years and high salary, it makes a huge difference.

( This is the special rate that rewards you for every single year of your service )

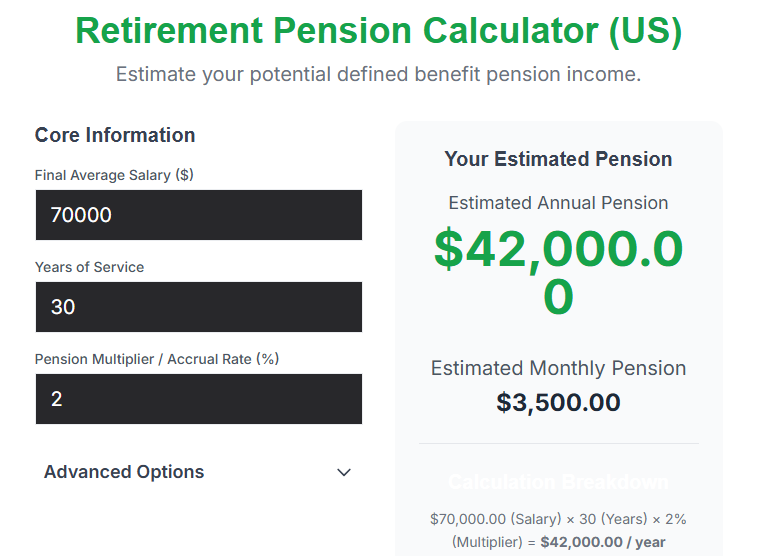

Okay so now let’s consider all this as an example.

There is a girl named Jenny….

Years of Service – 30 years

Final Average Salary – $70000

Pension Multiplier – 2%

Now, lets plug it into the Formula

30 years × $70000 × 2% = $42000 / Year

That’s it! Jenny will get $42000 every year Pension for the rest of her life.

And if this is broken down monthly, she will get $3500 Before taxes for her lifetime.

Don’t Want to do the Math ?

If you are still having trouble understanding this calculation, then don’t worry!

You can easily calculate your pension using our “Retirement Pension Calculator (US)”.

Retirement Pension Calculator (US)It is also completely Free and Easy to use, with a User Friendly UI.